How to Measure Stand Alone Risk

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Usually measured by standard deviation or coefficient of variation.

Standalone Risk Meaning Measurement Efinancemanagement

We can get an idea of a projects stand-alone risk by evaluating the projects future cash flows using statistical measures sensitivity analysis and.

. Hence it is more likely to estimate standalone risk qualitatively. In the vast majority of cases all three types of risk are highly correlatedif the general economy does well so will the firm and if the firm does well so will most of its projects. Risk in capital budgeting - lecture 10 outline risk analysis in capital budgetingcustomized text-chapter 10much of the lecture is outside Stand-alone risk.

The tighter the distribution the less the variability of the outcomes and the less risk associated with. Individual standard deviation Individual variance Individual coefficient of variance etc. Comparing interest rate risk and reinvestment rate risk b.

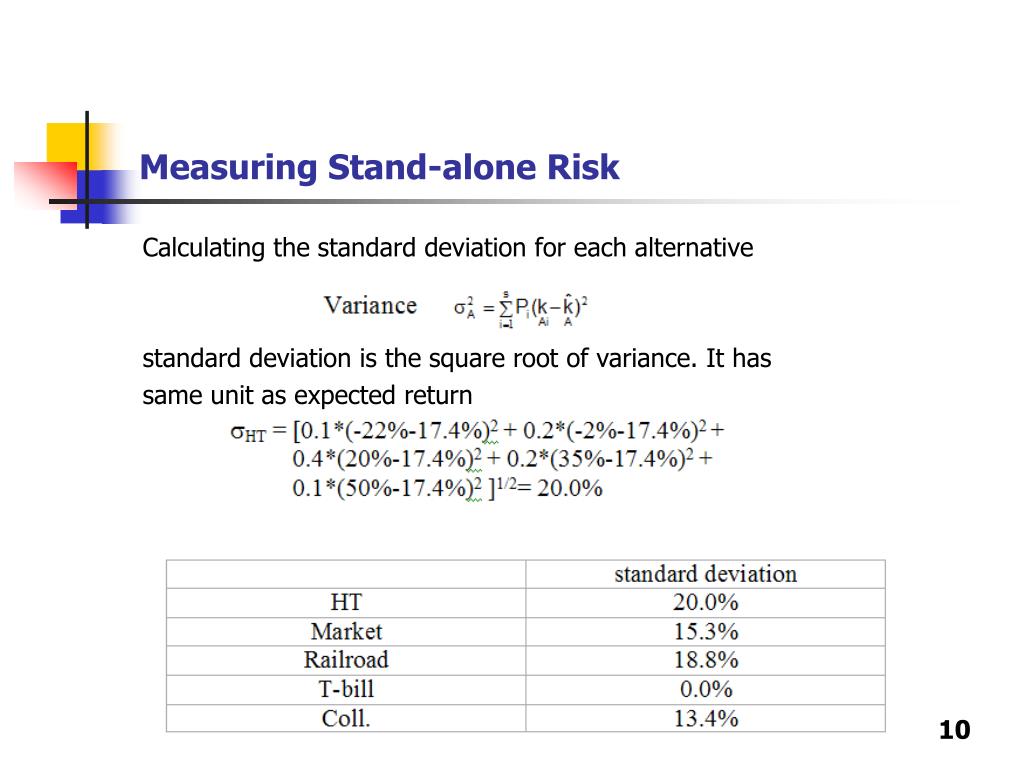

And a projects stand-alone risk is easier to measure than its market risk. The Standard Deviation σmeasures the tightness or variability of a set of outcomesthat is σ measures the tightness of a probability distribution. Surveys of Experts 34.

Stand - alone risk Corporate risk Market risk Stand - alone risk The project s total risk if it were operated independently. We will describe three alternative attitudes towards risk settling on risk aversion as being the standard assumption made in financial markets. Technically this statistic measures the proportion of variance in the dependent variable that is predictable from the independent variables.

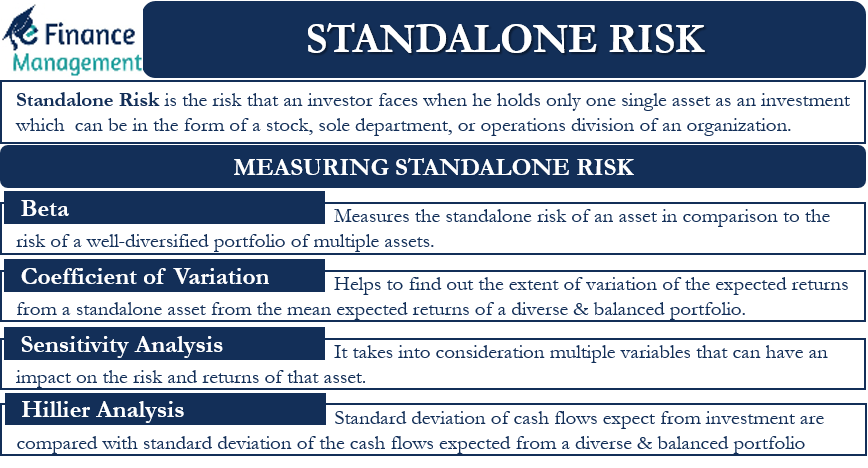

Stand-alone risk is often closely related to market risk. Three ways to measure stand-alone risk in capital budgeting are Monte Carlo Simulation Sensitivity Analysis and. Measuring Standalone Risk.

Risk measurement is a very big component of many sectors of the finance industry. Standalone risk can be measured with a total beta calculation or through the coefficient of variation CV. Stand-alone risk measures the undiversified risk of an individual asset.

Statistical measures of stand-alone risk Remember the expected value of a probability distribution is a statistical measure of the average mean value expected to occur during all possible circumstances. The Standard Deviationmeasures the tightness or variability of a set of outcomesthat is a probability distribution. To compute an assets expected return under a range of possible circumstances or states of nature multiply the anticipated return.

R-Squared 2 - Actuaries have long used R Squared as the standard for evaluating how accurately risk scores predict aggregate population costs. It is easier to estimate a projects stand-alone risk than its corporate risk and it is far easier to measure stand-alone risk than market risk. The projects total risk if it were operated independently.

An assets stand-alone risk is the risk an investor would face if he or she held only this one asset. The tighter the distribution the less the variability of the outcomes and the less. Defining Attitudes Towards and Alternative Measures of Risk This week we will define a statistical measure of stand-alone risk as being the standard deviation of returns.

While it plays a role in economics and accounting the impact of accurate or faulty risk measurement is most. It is easy to measure the standalone risk of a new delivery truck or a home improvement warehouse as there are numerous quantitative techniques such as scenario analyses sensitivity analyses and Monte Carlo simulations. In many cases projects with higher standalone risk may also have higher market risk.

Usually measured by standard deviation or coefficient of variation. However it ignores the firms diversification among projects and investors diversification among firms. They can measure its beta coefficient of variation or use other measures as mentioned above.

They may also minimize this risk by efficient diversification of their portfolio. A risk analysis technique that shows how much a projects NPV wll change in response to a given change in an input variable such as. Because of this high correlation stand-alone.

However it ignores the firm s diversification among projects and investors diversification among firms. This will help them to. Investors can include different kinds of stocks or assets and create a balanced portfolio.

Analysts across companies use. Investors should thoroughly assess the standalone risk of their investment. Measuring stand-alone risk using realized data Aa Aa 5 Returns earned over a given time period are called realized returns.

Historical data on realized returns is often used to estimate future results.

Assessing Stand Alone Risk Boundless Finance

Ppt Chapter 5 Risk And Rates Of Return Powerpoint Presentation Free Download Id 14774

No comments for "How to Measure Stand Alone Risk"

Post a Comment